The Power of Compounding

Downloads

The Power of Compounding

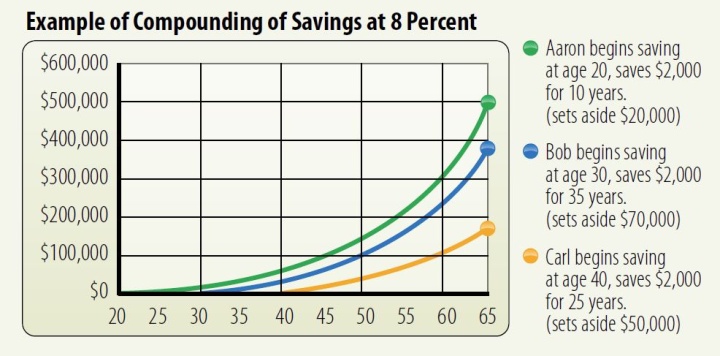

Consider the hypothetical case of three people—Aaron, Bob and Carl. Aaron begins to save for retirement at age 20 and saves $2,000 per year for 10 years. Carl doesn't begin saving for retirement until age 40 and contributes $2,000 each year until he reaches age 65. Bob begins saving at age 30 and contributes $2,000 each year until age 65. Neither of the last two will have as much at retirement as Aaron, thanks to the power of compounding.

Assuming a growth rate of 8 percent each year, as the chart below shows, both Bob and Carl will contribute considerably more than Aaron, but will end up with from about $100,000 to $300,000 less at age 65—and Aaron can stop contributing at age 30. The reason is the power of compounding. It pays to begin saving early.